Fisker founder and CEO Henrik Fisker shares his company's success in creating cost-efficient electric vehicles and weighs in on future innovations needed to improve America's energy efficiency.

General Motors Co. will offer buyouts to US Buick dealers as an alternative for franchise owners who don't want to make investments that will be needed as the brand goes all-electric, an executive said.

Global Buick chief Duncan Aldred confirmed in an interview that all of Buick's roughly 2,000 US franchise dealers will be given the opportunity to take a buyout. A dealer who takes a buyout would give up the Buick franchise and no longer sell the brand, although nearly all Buick dealers also sell other GM models. Mr. Aldred is scheduled to outline the plan during a virtual dealer meeting Friday.

GM said in June that Buick would transition to sell exclusively electric vehicles by 2030. That will require substantial investments in charging stations and store upgrades, along with other changes in the way dealers do business, Mr. Alfred said.

2021 Buick Envision (Buick)

GENERAL MOTORS CEO MARY BARRA DISCUSSES EV PRODUCTION AND TACKLING SUPPLY CHAIN CHALLENGES

"Not everyone necessarily wants to make that journey, depending on where they're located or the level of expenditure that the transition will demand," he said. "So if they want to exit the Buick franchise, then we will give them monetary assistance to do so."

Mr. Aldred declined to say how many dealers he expects to accept the buyout offer. A similar program completed for GM's Cadillac brand last year resulted in the phaseout of several hundred of Cadillac's US franchise dealers.

Nearly all of Buick's dealers also have at least one of GM's three other brands, most notably GMC. Most dealers who take a buyout likely would continue to operate their stores while selling one or more of the other three GM brands, without stocking Buicks, Mr. Alfred said.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GM | GENERAL MOTORS CO. | 38.47 | -0.09 | -0.23% |

The move points to the shifting landscape for car dealers as auto makers race to populate their showrooms with plug-in vehicles.

Many auto makers are requiring dealers to make expensive store renovations to accommodate charging stations and special equipment needed to service EVs. Facility improvements, which sometimes require piping in more electricity to the building, can run more than $300,000 in investment costs, dealers have said.

Traditional auto makers are also using the nascent EV transition to change some longstanding operational norms at their US dealerships. Those changes are often aimed at delivering a retail experience akin to that of Tesla Inc. and other startup EV makers, which don't use franchise dealers and have control over pricing and customer interactions.

GM's Cadillac buyout, initiated in 2020 and completed last year, trimmed the luxury brand's US dealer network by roughly one-third, to around 575 franchises, the company has said. GM has said it spent around $275 million on activities related to that program.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| F | FORD MOTOR CO. | 15.16 | -0.03 | -0.20% |

| TSLA | TESLA INC. | 270.21 | -6.95 | -2.51% |

Ford and GM recently introduced theirs first electric pickup trucks.

Both Buick and Cadillac plan to sell electric vehicles only by 2030, GM has said. Buick today doesn't sell any EVs in the US but plans a new battery-powered SUV sometime in 2024, which will mark the beginning of a full changeover to electric models. Other changes will coincide with the transition, including a new logo and marketing campaign, the company said.

CLICK HERE TO READ MORE ON FOX BUSINESS

Buick's US market share has held steady in recent years, around 1.2%, but has shrunk by nearly half since 2000, according to data from research firm Motor Intelligence. The brand has long ranked near the bottom on industry-wide sales-per-store measures, and some dealers have complained over the years that there are too many Buick stores.

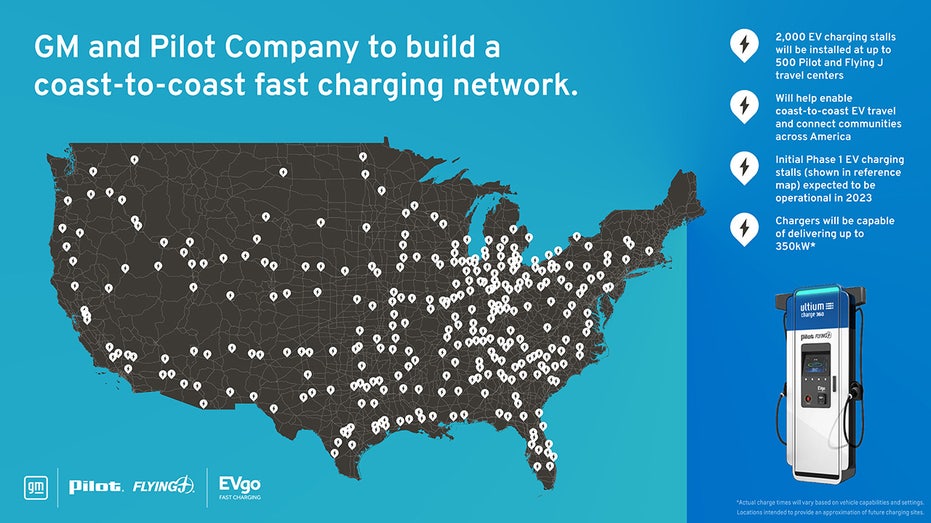

GM and Pilot Company to Build Out Coast-to-Coast EV Fast Charging Network (GM/Fox News)

Buick is strongest in China, where it sells more than four times the number of vehicles it does in the US

The electric push for Buick is part of GM's effort to convert nearly all of its global vehicle lineup to electric by 2035. Like many auto makers, GM is spending tens of billions of dollars on the switch, including on a new battery-cell factory that opened this week in Ohio. Three more US cell plants are either being built or in the planning phase.