The Biden Administration is gearing up to deliver $300 billion in student loan forgiveness.

Unlike pandemic stimulus checks, retail investors are unlikely to use debt relief to rush into stocks.

Individual investors now have to contend with hot inflation and a slump in asset prices.

The US government's $300 billion student loan forgiveness plan will provide financial relief to millions of Americans, but don't expect a replay of the "stimmy" boom of retail investors who used pandemic stimulus checks to load up on stocks and cryptocurrencies, market experts told Insider.

"I don't expect it to ignite a new meme-stock rally. These are monthly payments that will lead to some of those assets flowing into the market over time that otherwise would have gone to pay off debt. I don't think there's going to be a big wave of capital rushing into the markets," Richard Smith, CEO of RiskSmitha risk-assessment tool for retail investors, told Insider.

President Joe Biden recently outlined the program that cancels up to $20,000 for some borrowers of federal student loans. More than 43 million people will be eligible under income requirements.

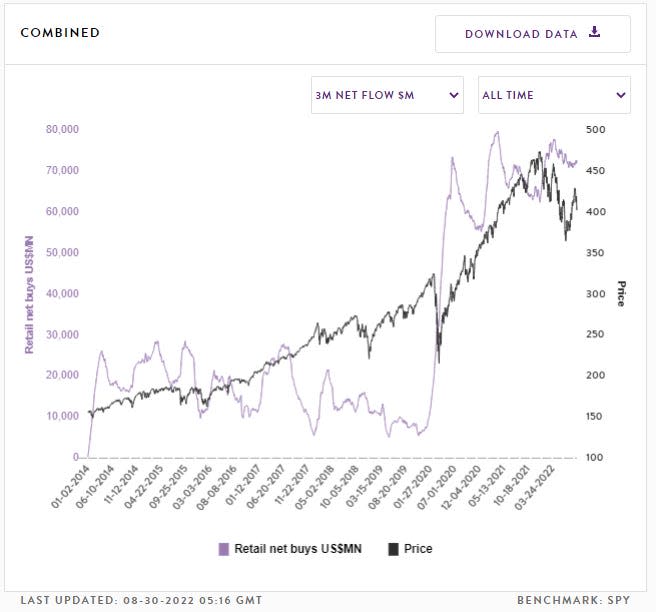

"While the effects of debt forgiveness may help re-kindle interest in highly speculative assets such as crypto or meme stocks by the younger generations, we believe the impact will be smaller than during the distribution of government stimulus checks," Marco Iachini, senior vice president of research at Vanda Research, said in emailed comments. Vanda tracks US retail investing activity in individual stocks and ETFs.

Debt forgiveness "will probably have a marginally positive impact on middle- and lower-income consumers over the long-run, but it is unlikely to have a meaningful impact on the economy or stock market near-term," said Ross Mayfield, investment strategy analyst at Baird.

"Stimmy" phase

Retail investors stormed the stock market in 2021 as they drove huge gains in meme stocks including GameStop, AMC Entertainmentand Bed Bath & Beyond. Many young people used stimulus- or "stimmy"- money to battle hedge funds shorting such stocks.

Student debt forgiveness applications will start in October and about 8 million people will be processed automatically. During the pandemic, the government sent three rounds of stimulus checks, and individual tax filers received a total of $3,200 between April 2020 and March 2021 via checks or bank deposits.

"Those checks replenished cash accounts as soon as they hit citizens' mailboxes," said Iachini. From an implementation perspective, loan borrowers may not see the impact until the end of 2022 or early in the first quarter of 2023, he said.

The average monthly student loan payment is around $400-$500, including private loans compared with the stimulus impact of $3,200 for each adult, Vanda said.

"It would therefore take about 6-8 months on average to reach the same impact while the eligible share of beneficiaries (% of population) is smaller relative to the wide reach of stimulus checks," Iachini wrote.

An estimated $100 billion of the $800 billion total from stimulus checks made its way to the stock market, according to a working paper co-authored by an economist at Harvard Business School and two finance professors at NYU's Stern School of Business published in March.

The newfound money energized retail investors with millions of them stuck working from home, or out of work, because of COVID. Alongside the meme-stock craze, bitcoin climbed to a record above $68,000 in November 2021.

Inflation bites

But retail investors are in a different place compared to 2021 when the S&P 500 flew up nearly 27%. Stocks have since plunged into a bear market. There's been a resurgence in meme-stock activity led by Bed Bath & Beyond, but Vanda said speculative buying looks set to wane through the rest of 2022.

Inflation will be a major reason why many loan borrowers won't reallocate forgiven debt payments to stocks or cryptocurrencies.

"In the last 12 months, the cost of everything else they buy has gone up – the cost of gasoline, cost of food, mortgage rates. So I suspect that some of that $300 billion will probably be used just to offset some of the cost of living increases," David Sacco, practitioner in residence of finance at the Pompea College of Business at the University of New Haven, told Insider.

"People are more risk-sensitive because they've been burned," said Smith. "Bitcoin went [down] to $19,000. Lots of risk-on bets that were very popular during the pandemic are down and people are underwater on those positions."

Repayments for federal student loans will restart in January 2023. A March survey by Student Loan Hero found that 6% of respondents used paused repayment money to invest in the stock market, well below the 52% who used the money to pay for rent and other household expenses.

"I do believe that whatever [debt-forgiveness] money does go into the investment side of things will probably go into more traditional, safer investments," said Sacco.

Read the original article on Business Insider