Sebastian Rothe / Eyeem | Eyem | Getty Images

Households may soon be able to claim thousands of dollars in tax breaks and rebates if they take steps to reduce their carbon footprint.

But eco-friendly consumers must wait until 2023 — perhaps even 2024 or later — to see many of those financial benefits.

The Inflation Reduction Act, which President Joe Biden signed into law on Aug. 16, represents the largest federal investment to fight climate change in US history. Among other measures, the law offers financial incentives to consumers who buy high-efficiency appliances, purchase electric cars or install rooftop solar panels, for example.

Those incentives and various qualification requirements kick in according to different timelines. Here's when consumers can expect to see them and how to decide when to make a purchase.

When to get tax breaks for new, used electric vehicles

Tomekbudujedomek | Moment | Getty Images

There are many moving pieces tied to incentives for new and used electric vehicles — and each may influence when a consumer chooses to buy.

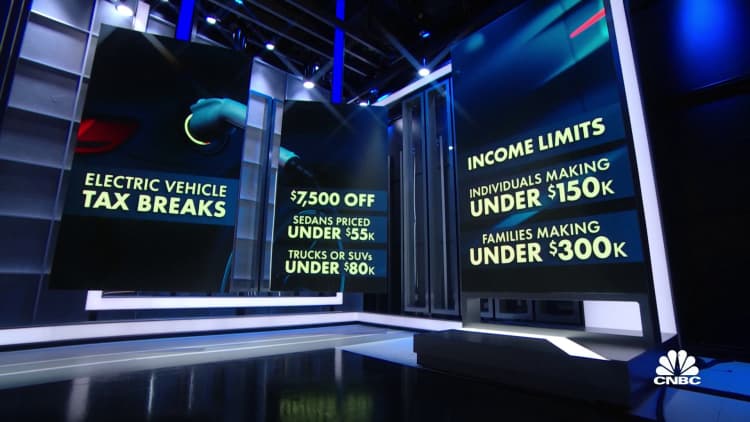

Consumers who buy a new electric vehicle can get a tax credit worth up to $7,500. Used vehicles qualify for up to $4,000. Each credit comes with various requirements tied to the consumer and vehicle, such as household income and sales price.

Consumers may also be eligible for additional electric-vehicle incentives from state and local governments or utility providers, for rules already on the books.

The timing for used vehicles is relatively straightforward: Purchases qualify for the new federal tax break starting in 2023. This "credit for previously-owned clean vehicles" is available until the end of 2032. However, consumers in the market for a used vehicle may wish to wait until 2024 or later (more on that in a bit).

More from Personal Finance:

What you can expect from Labor Day weekend car shopping

Identity scams are at an all-time high

48 million families can get free or cheap high-speed internet

Timing for new vehicles is more complex. There are three timeframes worth considering, each with their own benefits and drawbacks: purchases in 2022, 2023 and 2024 onward, according to Joel Levin, executive director of Plug In America.

There was a tax break for new electric vehicles already on the books — also worth up to $7,500. But the Inflation Reduction Act tweaked some rules that may limit who qualifies in the near term.

One rule took effect when Biden signed the law Aug. 16. It stipulates that final assembly of the new car must take place in North America.

Benefits and drawbacks of buying in 2022 or 2023

Mascot | Mascot | Getty Images

Two other rules take effect in 2023. One carries requirements for sourcing of the car battery's critical minerals; the second requires a share of battery components to be manufactured and assembled in North America. Consumers lose half the tax credit's value — up to $3,750 — if one of those requirements isn't met; they'd lose the full $7,500 for failing to meet both.

Additionally, consumers' household income and a vehicle's retail price must fall below certain thresholds starting in 2023 to qualify for a tax break.

Consumers who buy in 2022 can avoid those requirements; however, they would still be subject to the North American final-assembly rules that took effect in August. The IRS and US Department of Energy have tips to help consumers determine which car models qualify.

Many new electric vehicles may not be immediately eligible for the tax break in 2023 as companies work to meet new manufacturing rules, according to experts.

"If you want an EV, go buy an EV, [but] to wait four months for the credit is risky," Levin said. "There's a lot of uncertainty what will be available Jan. 1."

One potential upside to waiting until 2023 or later: Purchases of General Motors and Tesla car models would be eligible. They are not eligible in 2022 due to existing restrictions on the tax credit that will expire next year.

"If you're looking at those two and are really concerned about getting a [tax] credit, you should wait," Levin said. Of course, consumers would need to meet income and sales-price rules at that point.

Consumers who buy qualifying cars in 2022 or 2023 would only get the tax credit when they file their tax returns — and then only if they have a tax liability. That means consumers may wait several months to a year for their benefit, depending on purchase timing.

"If your tax liability is $5,000, you can use $5,000 of the credit — the other $2,500 goes poof," Steven Schmoll, a director at KPMG, said of the new-vehicle credit.

A more 'consumer-friendly' EV rule in 2024

Mascot | Mascot | Getty Images

But, starting in 2024, a new mechanism would essentially turn the tax break into a point-of-sale discount on the price of new and used electric vehicles. Consumers would not have to wait to file their taxes to reap the financial benefit — the savings would be immediate.

"That's really valuable, particularly for people who don't have a lot of money in the bank," Levin said. "It's a ton more consumer-friendly."

Here's how the mechanism works: The Inflation Reduction Act lets a buyer transfer their tax credit to a car dealer. A dealer — which must register with the US Department of the Treasury — would receive an advance payment of the consumer's tax credit from the federal government.

In theory, the dealer would then provide a dollar-for-dollar break on the car price, Levin said. He expects dealers to use the funds as a buyer's down payment, which would reduce the upfront cash necessary to buy a car. Some negotiating may be involved on the consumer's part, he added.

These transfers apply to new and used cars purchased starting Jan. 1, 2024.

When to get tax breaks for home efficiency upgrades

Artistgndphotography | E+ | Getty Images

There are two tax credits available to homeowners who make certain upgrades.

The "nonbusiness energy property credit" is a 30% tax credit, worth up to $1,200 a year. It helps defray the price of installing energy-efficient skylights, insulation and exterior doors and windows, for example. The annual cap is higher — $2,000 — for heat pumps, heat pump water heaters and biomass stoves and boilers.

The "residential clean energy credit" is also a 30% tax credit. It applies to the installation of solar panels or other equipment that harness renewable energy like wind, geothermal and biomass fuel.

Each policy enhances and tweaks existing tax breaks set to expire soon, extending them for about a decade.

That's really valuable, particularly for people who don't have a lot of money in the bank.

Joel Levin

executive director of Plug In America

The tax credits cover project costs and apply in the year that the project is finished. In legal terms, the project is completed when it is "placed in service."

The enhanced residential clean energy credit is retroactive to the beginning of 2022. So, solar panel installations and other qualifying projects completed between Jan. 1, 2022 and the end of 2032 qualify for the 30% credit. Those finished in 2033 and 2034 qualify for lesser credits — 26% and 22%, respectively.

The enhanced nonbusiness energy property credit is available for projects completed after Jan. 1, 2023 and before the end of 2033. There are some exceptions — oil furnaces and hot water boilers with certain efficiency ratings only qualify before 2027, for example.

"If you complete and install a project in 2022, it's not going to be eligible for the new incentive," Ben Evans, federal legislative director at the US Green Building Council, said of the nonbusiness energy property credit. "Look ahead and start planning projects, because it'll take time to do some of them."

Costs incurred in 2022 for a project completed in 2023 would still count towards the overall value of the homeowner's tax break, according to Schmoll of KPMG.

One caveat: Since these are tax credits, consumers will only get the financial benefit when they file their annual tax returns.

When rebates for home upgrades will be available

Florian Roden / Eyeem | Eyem | Getty Images

The Inflation Reduction Act also creates two rebate programs tied to clean energy and efficiency: one offering up to $8,000 and another up to $14,000.

Unlike some of the tax credits, these rebates are designed to be offered at the point of sale — meaning upfront savings for consumers.

One catch: They likely won't be widely available until the second half of 2023 or later, according to experts. That's because the Energy Department must issue rules governing these programs; states, which will administer the rebate programs, must then apply for federal grants; after approval, they can start issuing rebates to consumers.

If your tax liability is $5,000, you can use $5,000 of the credit. The other $2,500 goes poof.

Steven Schmoll

director at KPMG

The law does not set a required timeframe for this process.

Even according to the most optimistic timeline, those funds may not become available to consumers until summer 2023, according to Kara Saul-Rinaldi, president and CEO of AnnDyl Policy Group, an energy and environmental policy strategy firm

"Everything is going to depend on how quickly these guidelines can be written and put in place," said Saul-Rinaldi, who helped design the rebate programs.

Some states may also decide not to apply for the grants — meaning rebates wouldn't be available to homeowners in those states, Saul-Rinaldi added.

The HOMES rebate program offers up to $8,000 for consumers who cut their home energy via efficiency upgrades, such as insulation or HVAC installations. Overall savings depend on energy reduction and household income level.

Vitranc | E+ | Getty Images

The "high-efficiency electric home rebate program" offers up to $14,000. Households get rebates when they buy efficient electric appliances: up to $1,750 for a heat pump water heater; $8,000 for a heat pump for space heating or cooling; and $840 for an electric stove or an electric heat pump clothes dryer, for example. Non-appliance upgrades like electrical wiring also qualify.

Rebates from the "high-efficiency" program are only available to lower-income households, defined as those earning less than 150% of an area's median income.

Steve Nadel, the executive director of the American Council for an Energy-Efficient Economy, expects most states to participate; they're unlikely to pass up free money for residents from the federal government, he said.

Large states "who have their act together and have the staff" may be able to start offering the rebates as soon as early 2023, he said.